There are a number of start-up and ongoing costs associated with setting up and running a franchise, including:

- Initial Franchise Fee: This is what you pay the franchisor to buy the business and it may or may not include training, location selection, ongoing support etc. What this initial fee covers should be detailed in the franchise disclosure document (FDD) and in the franchise agreement.

- Capital Investment: Securing a location and/or equipment in accordance with the franchise package specifications, which could entail hiring contractors for construction and remodeling. You may have to buy start-up inventory. There will be other, not-so-obvious costs too, such as insurance, property taxes, accountant and legal bills, and even zoning fees.

- Working Capital: The money you’ll need to survive the initial start-up phase, including training, until business revenues begin to grow. You may have to pay employees before the business makes any money.

- Continuing Fees: In the form of royalties, management service fees and for advertising and marketing.

New Franchise & Business Opportunities for Sale in Canada

Now, how will you pay for all this?

If you're lucky, you have enough in savings to be able to last until your franchise begins making a profit. In select other cases, the franchisor might offer a financing package you can take advantage of. Most likely, however, you will be seeking loans from financial institutions, and you will need to present a credible business plan in order to secure financing.

The Importance of the Business Plan

With every loan, lenders take a risk, but by asking for all of this detailed information contained in the credit report and business plan, lenders strive to take on as little risk as possible.

They look for businesses that show promise awarding loans to businesspeople that have shown solid personal and business financial responsibility, and are committed to the success of their businesses.

What is a Business Plan?

A business plan is a formal document that details an entrepreneur's upcoming business venture. It is very detailed, including information on the objectives and forecast for the soon-to-be business.

Creating a business plan sounds complicated, but it doesn’t have to be. Most business plans follow a fairly uniform format, which you can find online or in business books. And after you’ve pulled together all the raw information you need, you can hire a professional writer to polish the content for final presentation.

In addition, some franchisors provide help with the business plan. Much of the information needed can be found in the FDD supplied to you.

This information provided includes, but not limited to: the company’s management structure, market demographics, day-to-day operational procedures, a marketing plan, start-up and ongoing costs.

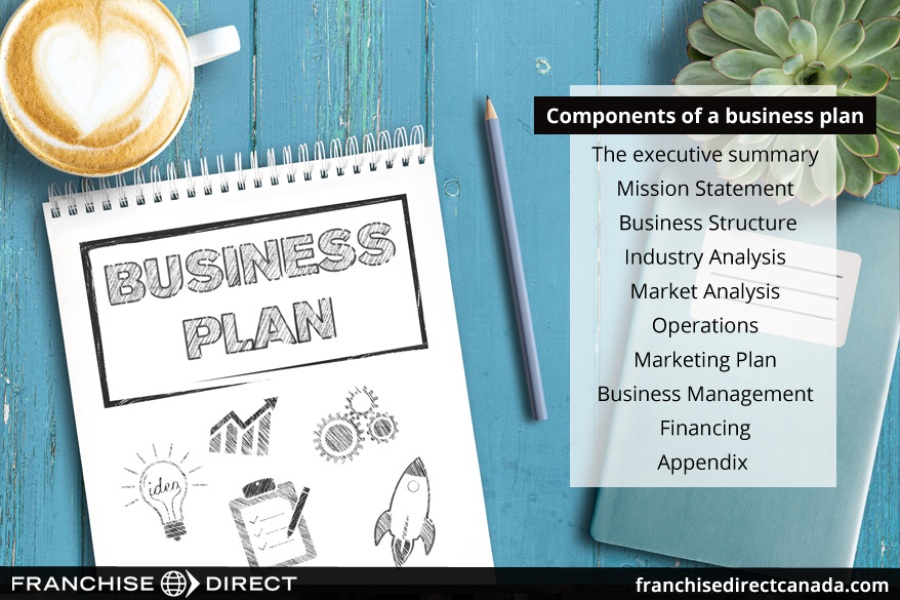

Elements of a Franchise Business Plan

Basically, you’ll need to start with an executive summary that describes the franchise, the products and services offered, the target market, the competition, your competitive advantage, and projected revenues and return on investment.

The executive summary is just what it sounds like and sums up the whole business operation. It is the initial pitch, and it shouldn’t be too long – limiting it to one page is a good target length. It should be easy to read and persuasive about your business prospects. If the executive summary does not capture the financier’s interest, then you probably won’t get your funding.

Other typical components of a business plan are:

- Mission Statement: Describes the purpose of your business, and outlines your (and the franchisor’s) philosophy regarding products, customers, employees, vendors, operations and community involvement.

- Business Structure: Details the company history, its management hierarchy, growth record, any debts, public and private equity shares, etc.

- Industry Analysis: This portion of the business plan is where you make the most positive pitch about your prospects by presenting facts about the industry such as its size, growth rate, industry leading companies, different market segments, future potential projections by industry analysts, etc. It helps to use charts here for quick comparison about growth projection, market segmentation, and competition. This section should include any information about business trends, legislative or environmental factors that can influence your business.

- Market Analysis: Provide data specific to your customer base, existing competition, your location, local trends and factors that can impact the growth of your business.

- Operations: The Operating Manual of the franchisor should provide you with the basics on your day-to-day operations, such as personnel, procurement, training, hours, and the operational procedures involved in producing and/or delivering your products and services to customers.

- Marketing Plan: Here you can present the franchisor’s marketing and advertising strategies, and what support you will get at the local level. You can describe the grand opening, any special pricing or promotions you’ll be offering, and anything that sets you apart from the competition.

- Business Management: Describe how you intend to manage the business on a daily basis, including the number of staff, their titles and responsibilities, how you will recruit them, and what salaries and benefits will be offered. Include your own experience and accomplishments, and what compensation you expect to get from the business. If you have already lined up individuals for management roles, then describe their qualifications and accomplishments.

- Financing: State how you intend to finance the start-up costs, possibly through a mix of personal savings, family loans and presumably a business loan. You will need to supply profit-and-loss forecasts and cash flow projections for at least the first three years. In this section, you must present the case for when you believe you will break even and make a profit. This is where the disclosures made by franchises in their disclosure documents can make an even bigger difference for prospective franchisees vs. independent business owners.

- Appendix: This is where you can attach documents such as your tax returns, media clips about the industry and the franchisor company, and any other pertinent materials you used for your market and industry research that present your franchise business plan in a positive light.

The franchisor will oftentimes will review your business plan, and make suggestions based on experience on how to improve it. However, as mentioned earlier, the franchisor is under legal restrictions about making any claims regarding projected earnings. Your accountant and lawyer should also review your business plan to ensure that everything is properly explained.

After all this hard work is done, it will be that much easier to approach your potential lending sources because you will be that much more confident in your plans after compiling—and reviewing—all of the information necessary for a business plan.